Topic 4: Economics on a National Scale

GDP

When looking at the entire economy, there are more than a couple of ways to see how it performs. The first is called Gross Domestic Product (GDP), and it is the dollar value of the total amount of output that an economy makes. Watch this video by Harvard Business School to understand what exactly GDP is, how to calculate it, and what it means in global trade.

Link HereThere are a few limitations, though on what GDP can actually cover. Here’s a video on how GDP is limited in its scope.

Link HereTo summarize, 5 things particularly are not included in GDP: nonmarket activities(not sold), illegal activities, intermediate goods (in between production and selling), used goods, and transfer payments. The two less obvious ones to highlight are intermediate goods and transfer payments. An example of an intermediate good is the milled flour sold to bakers to turn into bread, as the bread is sold as a part of GDP, so flour is only in between the production and final sale point. An example of a transfer payment is a tax write-off, where the government gives money back to people from their taxes. No sale or production of goods was made, only a transfer of money, so this is not a part of GDP.

Unemployment

There is another economic indicator that is more specific to the labor sector and how it is performing. That is unemployment. Here’s an excellent video about the unemployment rate, how it’s calculated, and what to consider when calculating it.

Link HereIf you're still confused, here’s a Khan Academy article to back that one up.

Lesson summary: Unemployment (Khan Academy)Lastly, a quick refresher on the types of unemployment. Frictional unemployment happens when people are temporarily between jobs or just entering the workforce, like after graduation. Structural unemployment occurs when there’s a mismatch between workers' skills and the jobs available, often due to technological advances or shifts in the economy. Cyclical unemployment is linked to the health of the economy, rising during recessions when businesses reduce their workforce due to lower demand for goods and services. Understanding these types helps explain why unemployment exists even in a healthy economy. Since frictional and structural employment are bound to happen, the natural rate of unemployment, which encompasses both, is typically 4%.

Inflation

The third economic indicator to look at is inflation. I’m sure you’ve heard people complain about inflation this, inflation that, but what actually is inflation? Is it always bad? This video talks more about this.

Link HereIt looks like inflation is not necessarily a bad thing, as the target inflation rate is actually 2%! However, we know that it lowers a currency’s purchasing power, or how much a unit of that currency, let’s say a dollar, can actually buy. But now, inflation can be looked at in terms of supply and demand as well, as both have an effect on how prices change in an economy. Here’s a video on just that.

Link HereThere are only a few more things to note about inflation, and those are the concepts of deflation, disinflation, hyperinflation, and stagflation. Deflation is simple: negative inflation, when prices fall. Disinflation is when prices rise, but at less of a rate than they used to, so the inflation rate has fallen. Hyperinflation is when prices rise significantly, more than 50% per month. Finally, stagflation is when inflation occurs, but the economy is stagnant, meaning GDP does not increase. Stagflation is really bad for an economy, and can cause high unemployment rates and slow an economy’s growth.

Interest

Finally, we have interest rates. An interest rate is the percentage of a loan that a borrower has to pay back to the lender per year. This is a great video on how interest rates work.

Link HereBut if I lend you money on a fixed interest rate, that interest rate isn’t actually fully coming back to me at face value. Actually what happens is that some of that value is lost because of inflation, since the purchasing power of the money has now fallen. Here’s a video on how to look at interest differently when factoring in inflation.

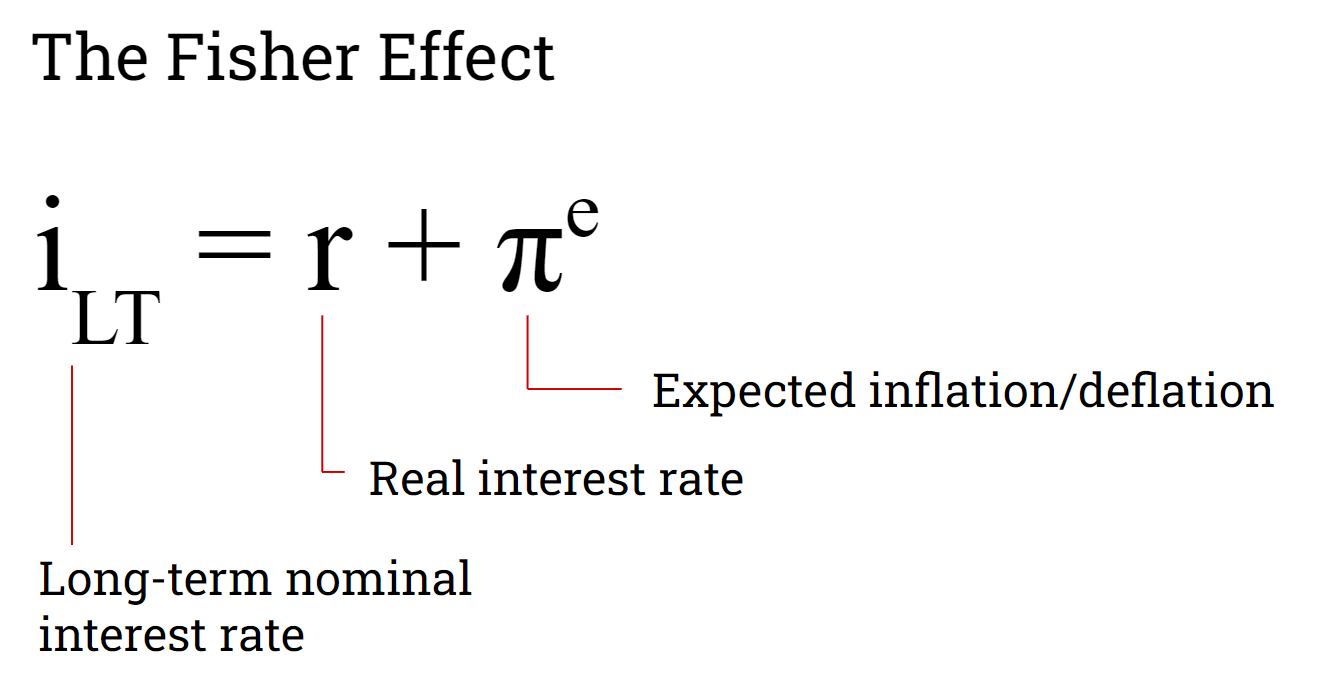

Link HereThus we reach something called the Fisher Effect, basically relating the nominal and real interest rates together using inflation.

But as a general rule, people like to save more in banks when interest rates are high, and borrow more when they are low.

Great job! You finished module 4!

Quiz

Take this quiz to test your knowledge!

What does GDP (Gross Domestic Product) measure in an economy?

Which of the following is a limitation of GDP as an economic indicator?

What component of GDP is represented by consumer spending on goods and services?

How does the unemployment rate affect the economy?

Which type of unemployment is caused by a downturn in the business cycle?

What does the inflation rate measure?

What happens to consumer spending when interest rates increase?

In which phase of the business cycle would you most likely see high unemployment and low consumer spending?